- Abuse & The Abuser

- Achievement

- Activity, Fitness & Sport

- Aging & Maturity

- Altruism & Kindness

- Atrocities, Racism & Inequality

- Challenges & Pitfalls

- Choices & Decisions

- Communication Skills

- Crime & Punishment

- Dangerous Situations

- Dealing with Addictions

- Debatable Issues & Moral Questions

- Determination & Achievement

- Diet & Nutrition

- Employment & Career

- Ethical dilemmas

- Experience & Adventure

- Faith, Something to Believe in

- Fears & Phobias

- Friends & Acquaintances

- Habits. Good & Bad

- Honour & Respect

- Human Nature

- Image & Uniqueness

- Immediate Family Relations

- Influence & Negotiation

- Interdependence & Independence

- Life's Big Questions

- Love, Dating & Marriage

- Manners & Etiquette

- Money & Finances

- Moods & Emotions

- Other Beneficial Approaches

- Other Relationships

- Overall health

- Passions & Strengths

- Peace & Forgiveness

- Personal Change

- Personal Development

- Politics & Governance

- Positive & Negative Attitudes

- Rights & Freedom

- Self Harm & Self Sabotage

- Sexual Preferences

- Sexual Relations

- Sins

- Thanks & Gratitude

- The Legacy We Leave

- The Search for Happiness

- Time. Past, present & Future

- Today's World, Projecting Tomorrow

- Truth & Character

- Unattractive Qualities

- Wisdom & Knowledge

Mastery Mondays

Today's World, Projecting Tomorrow

Inflation in 2025 - Groceries

We cannot predict with full certainty what the future holds. Sure, we can forecast and look at trends. History often repeats itself so we have good predictors of what’s to come.

So when we look ahead to see what inflation will likely be in 2025, there are some good indicators of what could happen. There are often some unknowns that could change what is predicted.

Where I live, inflation has been at an all time high over the past few years.

In fact, when I look over my grocery budget from the past 5 years, the increase is huge.

5 years ago, it was essentially just my husband and I. We had a one year old daughter, so her contribution to the grocery bill was fairly negligible. Back then, we budgeted between $600-$700 per month for groceries. That allowed us to buy good healthy food - albeit nothing fancy (we don’t eat steak and other expensive foods regularly). I cook meals at home and we eat out maybe once every two weeks.

*It’s also worth noting that I live on the West Coast of Canada and our cost of living is extremely high. You might think that sounds like a high grocery budget, but trust me, it bought the essentials and not much else!*

When we just finished up our budget from last month, we came in just over $1200. Again, that is not buying much for expensive or extra stuff - just good healthy food to make meals with.

At this point, we have two daughters (3 and 6) who are both light eaters - yes, they add some to our budget but not too terribly much.

$600 to $1200 is a full 100% increase to our budget in 5 years. Let’s be fair and keep our variables the same and say that we are spending $200 per month specifically on stuff for the kids that I wouldn’t be buying otherwise - that would leave us at $1000 per month. So $600 to $1000 is still a 66.67% increase in our grocery budget over the last 5 years.

That’s a big increase in 5 years!

Looking forward, I am sure hoping for some reprieve on inflation on the grocery front. What do you think is going to happen with inflation for the remainder of 2025?

Interesting Fact #1

The current annual inflation rate is 3%, still stubbornly above the Fed’s 2% target.

Interesting Fact #2

Consumers pay more close attention to cumulative inflation, and prices are 23% more expensive today than they were before the coronavirus pandemic recession began in February 2020.

Interesting Fact #3

Prices last month jumped 0.5 percent, the biggest surge since August 2023 as shelter, energy and grocery costs all increased, according to the Bureau of Labor Statistics’ monthly consumer price index (CPI) report. Excluding food and energy, so-called core prices rose 0.4 percent, the most since February 2024, thanks to increases in airfares, used cars and trucks, medical care, car insurance and more.

Quote of the day

“Inflation is when you pay fifteen dollars for the ten-dollar haircut you used to get for five dollars when you had hair.” ― Sam Ewing

Article of the day - Current U.S. Inflation Rate is 3%: Why It Matters

Inflation increased 0.5% in January 2025, putting the current inflation rate at 3%. Understanding inflation, why it matters and how to handle it can help when making financial decisions.

Today's inflation rate

The current U.S. inflation rate is 3% for the 12-month period ending in January 2025, up slightly from the 2.9% reported last month. The consumer price index (CPI), which measures changes in prices, increased 0.5%, according to the latest release from the Bureau of Labor Statistics (BLS)

[1]

.

The BLS notes that the index for shelter rose 0.4%, which accounted for almost 30% of the all items index. The energy index rose 1.1% over the month, gasoline was up 1.8% and food increased 0.4%. The next monthly update will be released on March 12, 2025.

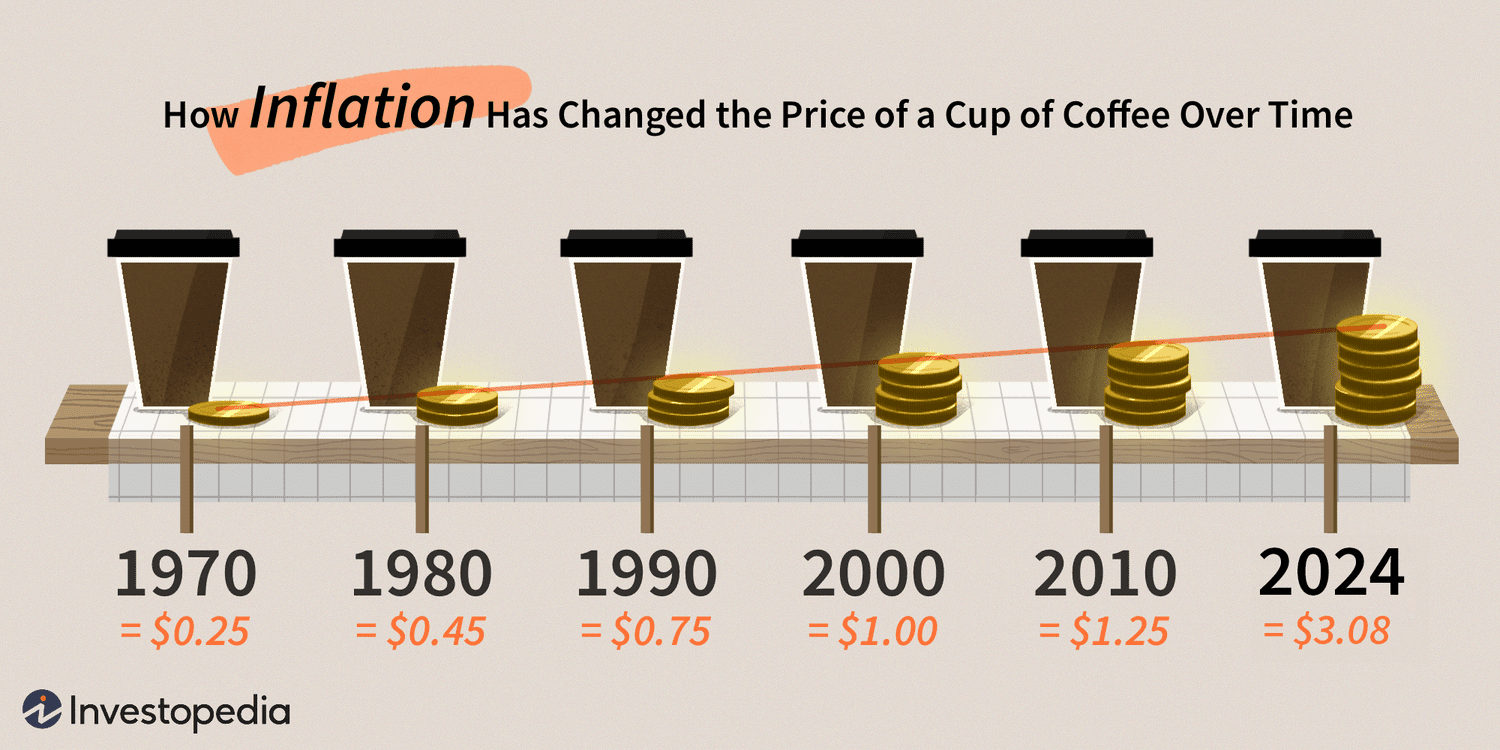

What is inflation?

Inflation is the rate at which the price of goods and services increases. As a result of inflation, the purchasing power (value) of money decreases over time. Inflation affects the prices of everything around us.

Generally speaking, inflation can be caused by a number of factors. The recent surge in inflation has been driven, at least in part, by supply chain issues, a housing crisis, pent-up consumer demand and economic stimulus from the pandemic.

Types of inflation

There are many types of inflation, characterized by either a root cause or the rate of increase:

-

Cost-push. A common cause of inflation is when the costs of producing goods and services increase and push prices higher. This can happen when prices of raw materials or labor costs rise.

-

Demand-pull. Another cause of inflation is when the demand for goods and services outstrips what can be produced at the time, making prices go up.

-

Deflation. The opposite of inflation — a negative inflation rate or a drop in prices of goods and services.

-

Disinflation. A falling rate of inflation or slowdown in the rise in prices of goods and services.

-

Reflation. A way to curb deflation, when a government purposely stimulates the economy by increasing the money supply or government spending — such as the COVID stimulus payments. Reflation can also happen when a government lowers interest rates.

-

Creeping. Low or mild inflation with prices rising less than 3% a year.

-

Walking (trotting). Prices rise moderately, but the annual inflation rate stays in the single digits.

-

Running (galloping). Prices increase significantly into the double digits, above 10% a year.

-

Hyperinflation. Extraordinary inflation spiraling out of control, over 1,000% a year.

-

Stagflation. High inflation even during an economic downturn.

How to measure inflation

One commonly used inflation metric is the consumer price index, or CPI, calculated by the U.S. Bureau of Labor Statistics

[2]

. The bureau measures CPI by monitoring the average change in prices paid for a variety of goods and services, classified by eight groups: food, housing, apparel, medical care, recreation, transportation, education and communication, and other goods and services.

There are other metrics that tell us about the inflation story, such as the personal consumption expenditures price index. PCE is calculated by the U.S. Bureau of Economic Analysis, which also prices a different basket of goods and services from the CPI basket.

You might hear of inflation described as headline or core. Headline inflation measures total inflation for a certain time period. Core inflation attempts to pinpoint a more accurate read on inflation by excluding food and energy prices, which can fluctuate widely on a daily basis.

» Use our inflation calculator to see how your money's value changes over time.

Historical U.S. inflation rates

Looking at CPI for the 30 years from 1989 to 2019, the average annual inflation rate was 2.5%. The Federal Open Market Committee, the arm of the U.S. central bank that makes decisions about managing the nation’s money supply, targets a 2% rate of inflation over time.

The prices of different goods and services can rise at different rates. For instance, education and health care costs are generally subject to higher inflation rates than the average inflation rate.

According to finaid.org, a site that offers financial aid advice, tools and information, U.S. tuition rates are typically more than double the general inflation rate, and on average, increase about 8% each year

[3]

.

And according to the Centers for Medicare & Medicaid Services, national health spending is projected to grow at an average annual rate of 5.4% between 2022 and 2031

[4]

.

» Learn more: What causes inflation?

Why inflation matters

The effects of inflation are felt throughout an economy. As prices rise, what you can buy now will lessen over time. Being able to combat, or at least keep up with, inflation and sustain the purchasing power of your money is one of the main reasons to invest your money.

Consumers care about inflation because it affects costs and their standard of living. Businesses carefully watch the price of raw materials that go into their products, as well as what wages they need to pay their employees. Inflation affects taxes, government spending and programs, the level of interest rates and more.

A low, steady or predictable level of inflation is considered positive for an economy. It signals growth and healthy demand for goods and services.

As businesses generate more goods and services to keep up with demand, they need to hire more workers, which generally leads to higher employment and wage growth. Those workers then purchase things they need and want, and the cycle continues. However, when inflation gets too high or too low, it becomes dangerous because it’s hard to keep supply and demand, along with economic growth, in check.

This brings us to the importance of investing. Although you’ll earn interest from the bank on money in your savings account, the interest rate you receive usually won't match or even come close to beating the inflation rate. That’s why it can make sense to invest your money if you can afford to and grow that money’s value over time. That way, you can buy the same amount of goods and services in the future.

When creating a plan to reach your financial goals, it’s important to bake in a realistic inflation rate for future expenses so you’re saving enough to meet your needs.

How to protect against inflation

Avoid hoarding cash

To make sure your money doesn’t lose too much value, it’s important to invest and not keep too much money in cash, said certified public accountant Tony Molina in an email interview.

“The impulse to hang onto as much cash as possible is an understandable one, and it can feel reassuring to accumulate more of it in challenging situations as a buffer against unexpected events,” he said.

However, inflation means your money will probably buy less over time. Molina suggests investing the money you don’t intend to use in the next three to five years so that you can avoid a decrease in purchasing power.

» Get started: How to invest your savings for short- or long-term goals

Diversify your portfolio

Another way to prepare for inflation is by having a well-diversified investment portfolio. Diversification, when you spread your investments across asset classes (stocks, bonds, cash, real assets, etc.), various industries and countries, helps enhance investment returns while simultaneously reducing risk, such as from inflation.

There are certain investments that are more inflation-tolerant than others or rise together with inflation, Eric Leve, chartered financial analyst and chief investment officer of Bailard, a wealth management firm in San Francisco, said in an email.

Leve recommends including some of these natural inflation hedges as part of your overall portfolio to help defend against inflationary times, such as:

-

Real assets. Assets such as gold or real estate, which retain value or provide pricing power, help withstand inflation. For example, landlords sometimes raise rents as inflation rises.

-

Stocks. Especially stocks with proven earnings growth and low debt. Interest rates tend to rise with inflation, causing companies with high debt to face higher payments.

-

Treasury Inflation-Protected securities. During inflationary times, rising interest rates negatively impact traditional bonds because bond prices and interest rates have an inverse relationship. TIPs are a type of bond indexed directly to CPI meant to help investors preserve purchasing power; I bonds are another option tied to inflation.

» Learn more: Bond ETFs

Ask for help

Making sure your investments are set up to safeguard against inflation is important, and there are many factors to consider. Seeking a second opinion from a financial advisor can be useful to ensure that you’re on the right track and have prepared your portfolio to weather all seasons of varying economic environments.

Question of the day - What do you think is going to happen with inflation for the remainder of 2025?

Today's World, Projecting Tomorrow

What do you think is going to happen with inflation for the remainder of 2025?