Introduction: Urban areas are hubs of economic activity, innovation, and diverse financial opportunities. "Urban money" refers to the financial trends, challenges, and resources specific to metropolitan environments. From fintech solutions to urban investment strategies, understanding urban money is crucial for navigating the dynamic financial landscape of cities. Let's explore the concept of urban money, its implications, and the opportunities it presents.

Financial Trends in Urban Settings:

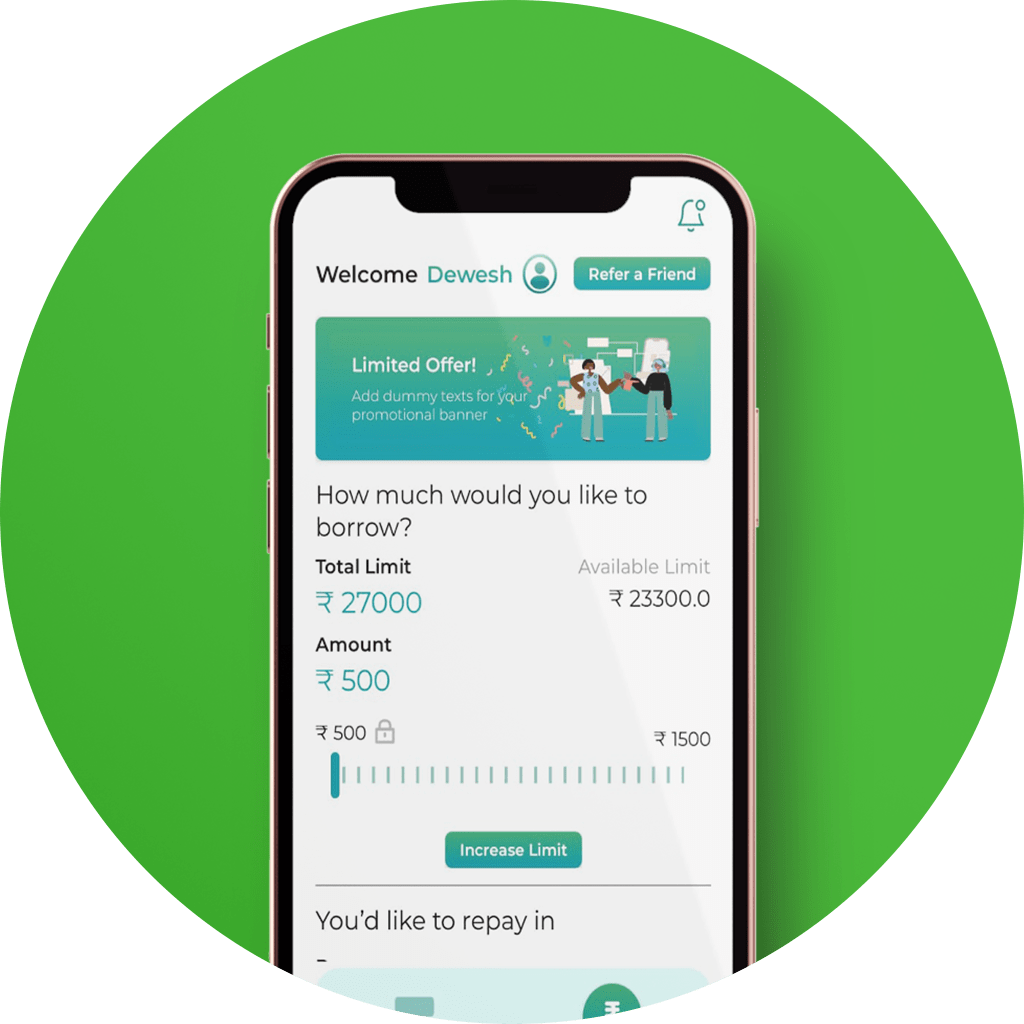

Fintech Revolution: Urban Money are at the forefront of the fintech (financial technology) revolution. These technologies, including mobile payment systems, digital wallets, and blockchain, are transforming how financial transactions occur in cities. Residents can now access banking services, make payments, and invest in assets seamlessly through their smartphones.

Cashless Transactions: With the rise of digital payment options, cashless transactions have become the norm in many urban centers. From retail stores to public transportation, cities are increasingly adopting cashless payment systems. This trend not only improves convenience for residents but also enhances transparency and reduces the risk of theft.

Urban Investment Opportunities: Urban environments offer a plethora of investment opportunities, ranging from real estate development to infrastructure projects. Investors are drawn to the potential for high returns in areas experiencing rapid urbanization and growth. Smart cities initiatives, renewable energy projects, and urban renewal programs are some examples of attractive investment avenues in urban settings.

Rise of the Gig Economy: Urban areas often serve as breeding grounds for the gig economy, where individuals work on a freelance or contract basis. The gig economy offers flexibility and opportunities for additional income, with platforms like ride-sharing services, food delivery apps, and freelance marketplaces thriving in urban centers.

Challenges in Urban Money Management:

Cost of Living: While urban areas offer economic opportunities, they also come with a higher cost of living. Housing costs, transportation expenses, and everyday essentials can be more expensive in cities compared to rural areas. Managing finances to cover these higher costs is a challenge for many urban residents.

Financial Inclusion: Despite advancements in fintech, not all urban residents have equal access to financial services. Financial inclusion remains a challenge, particularly for low-income communities and marginalized groups. Addressing this gap in access to banking, credit, and investment options is crucial for promoting economic equality in cities.

Debt and Financial Stress: The fast-paced lifestyle of urban areas can lead to increased spending and reliance on credit. Many urban residents struggle with debt and financial stress, especially in cities with high living costs. Managing debt and building financial resilience are ongoing challenges for individuals navigating urban money matters.

Opportunities for Financial Empowerment:

Financial Literacy Programs: Educational initiatives focused on financial literacy play a vital role in empowering urban residents. Workshops, seminars, and online resources can help individuals develop essential money management skills, such as budgeting, saving, and investing.

Community Investment Programs: Urban communities can benefit from local investment programs that promote economic development and social impact. Community development financial institutions (CDFIs) and microfinance initiatives support small businesses and entrepreneurs, fostering economic growth from within.

Sustainable Finance Initiatives: Cities are increasingly embracing sustainability and environmental responsibility. Sustainable finance initiatives, such as green bonds and impact investing, fund projects that promote renewable energy, green infrastructure, and climate resilience. These initiatives not only benefit the environment but also create investment opportunities for socially conscious investors.

Digital Financial Inclusion: Efforts to expand digital financial services to underserved urban populations are gaining momentum. Mobile banking, microfinance apps, and digital payment platforms are making financial services more accessible to those who were previously excluded from the traditional banking system.

Conclusion: Urban money encompasses the financial trends, challenges, and opportunities unique to metropolitan areas. From the fintech revolution to urban investment opportunities and the rise of the gig economy, cities are dynamic centers of economic activity. While challenges such as the high cost of living and financial inclusion persist, initiatives focused on financial literacy, community investment, and sustainable finance are paving the way for greater financial empowerment in urban settings. Understanding urban money is essential for individuals, businesses, and policymakers seeking to navigate and thrive in the complex financial landscape of cities.

For more info. visit us:

Comments