The first thing to do is find a payment service provider to manage bank receipts. Usually, the issuance of receipts has been associated with banks, but other options have been available for a long time, cheaper and easier to use. Let's see how to make a receipt according to the type of payment service provider.Banks are the classic option to issue receipts to your customers. But they require that you have a history with them and, in some cases, sign a credit policy with them for the amount you will process. The latter makes the issuance of receipts substantially more expensive.

On the other hand, they usually ask for guarantees, and, in addition, they come to withhold your money after collecting from the client for 8 weeks. The retention of money means that, even if you have the money in the account, you will not be able to use it until the return period of a receipt ends.

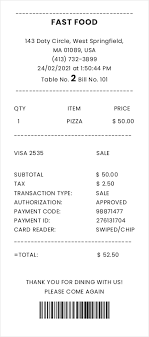

When creating receipts, banks offer archaic programs that make it very difficult to issue receipts. You have to generate SEPA XML files with special applications to be able to send receipts.Banks do not notify you through messages or other types of communication when they return a bank receipt. You will only be able to see it by entering the day-to-day account movements and looking for the receipt that has been returned to you. This greatly complicates the management of collections from your clients.Another issue to consider is that to make receipts, you must comply with the SEPA Regulation, which requires having a SEPA mandate signed by your client. When you operate with the Bank, you must collect the mandates. The bank will help you when making Builder Receipt. In addition, you must inform your client before each receipt of the amount and date on which they will be charged.

Operators (Online Platforms)

They are new companies focused on facilitating and digitizing operations usually only offered by bank operators. The advantage of these companies is that they automate the processes for recurring collections, they provide systems to sign the mandate, they have automatic recovery systems, notices of returns, etc. That is, they make all the operations much easier.It is necessary to remember that the Express Expense that wants to offer this type of service must be a Payment Entity or be associated with a Payment Entity, which will provide security for this type of operation.These platforms will also have to study your credit risk and are subject to the Regulation of Payment Institutions, so they will have to request certain information before operating with us.Free Receipt Template is use to facilitate the collection by direct debit and help your clients make a receipt. Among others, they offer the following functionalities:

- Automatic collection of receipts from the platform

- Payment through links by SMS and email

- Return notification system and automatic recovery of returned receipts

- No money withholding

- No commission for returned receipt

- Automatic billing so you don't have to waste time creating invoices

- Payment by card periodically or punctually

- Personalized customer service

If you want to try the Receiptwriter system to manage your credit card and direct debit payments and save time and money, try for 30 days free, without any commitment.

Comments