GCC Risk Management Market Overview

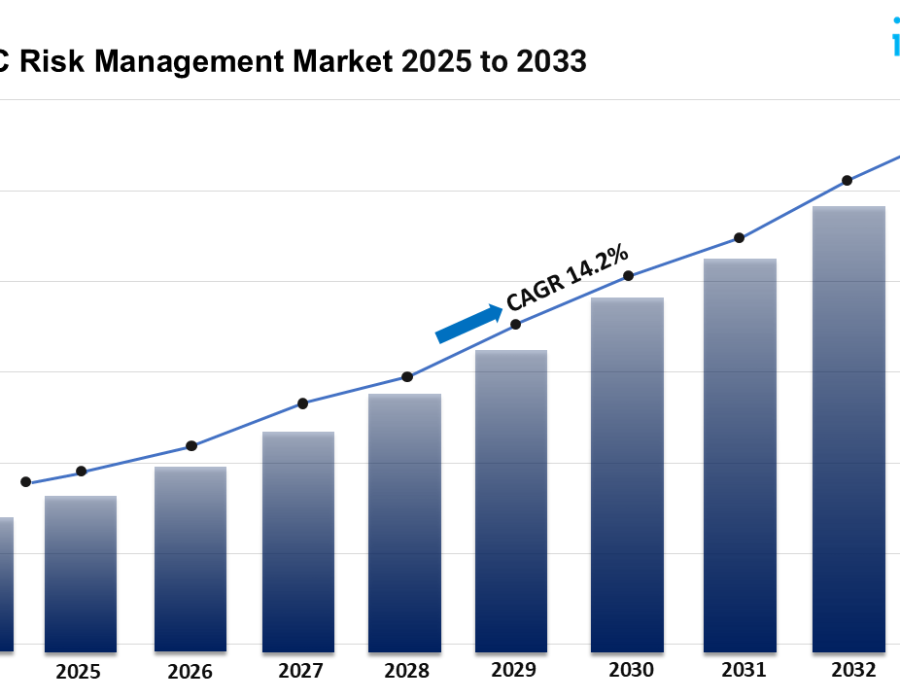

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Growth Rate: 14.2% (2025-2033)

Market Size in 2024: USD 257.0 Million

Market Forecast in 2033: USD 874.0 Million

The GCC risk management market is experiencing significant growth, driven by the increasing complexity of business environments, rising regulatory compliance requirements, and rapid technological advancements. According to the latest report by IMARC Group, the market is projected to grow at a CAGR of 14.2% from 2025 to 2033.

GCC Risk Management Market Trends:

The market in GCC is primarily driven by the increasing regulatory requirements across financial services, healthcare, and energy sectors, compelling organizations to adopt robust risk assessment frameworks. The growing complexity of cyber threats and data security challenges has heightened the demand for advanced risk management solutions, particularly in cloud computing and digital transactions. Additionally, the expansion of large-scale infrastructure and construction projects in the region requires comprehensive risk assessment to mitigate financial and operational uncertainties. The rising adoption of artificial intelligence (AI) and data analytics in risk modeling is enhancing decision-making capabilities for businesses. Furthermore, the integration of risk management practices within corporate governance frameworks is becoming a priority for organizations to ensure compliance and business continuity. The rapid digital transformation across industries, including fintech and e-commerce, is driving demand for proactive risk mitigation strategies. Moreover, increasing geopolitical and economic uncertainties in the region are pushing enterprises to adopt resilient risk management frameworks. Besides this, the rise in sustainability and environmental, social, and governance (ESG) considerations is leading organizations to implement structured risk assessment approaches to align with global best practices.

The scope of the market in GCC is expanding as businesses across diverse sectors recognize the importance of risk management in ensuring operational stability and regulatory compliance. As per the market analysis, the increasing reliance on AI-driven risk assessment tools and predictive analytics is creating significant growth opportunities for technology providers and consulting firms. The broadening market scope is evident in the rising demand for industry-specific risk management solutions, particularly in sectors such as energy, aviation, and logistics, where operational risks are high. Additionally, the surge in public-private partnerships (PPPs) and foreign investments in the region is driving the need for structured risk mitigation frameworks. The growing adoption of insurtech solutions and automated risk assessment platforms is also transforming traditional risk management practices. Moreover, advancements in blockchain technology are strengthening transparency and security in financial risk management. The increasing emphasis on crisis management and disaster recovery planning, especially in the wake of global disruptions, is fostering greater investment in risk assessment solutions. Furthermore, regulatory bodies in the region are actively promoting risk-based approaches to governance, further driving market expansion. Also, the integration of climate risk assessment into corporate strategies is expected to play a crucial role in shaping the long-term growth of the GCC risk management market.

GCC Risk Management Market Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest GCC risk management market share. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments:

- Component:

- Software

- Services

- Deployment Mode:

- On-premises

- Cloud-based

- Enterprise Size:

- Large Enterprises

- Small and Medium-sized Enterprises

- Industry Vertical:

- BFSI

- IT and Telecom

- Retail

- Healthcare

- Energy and Utilities

- Manufacturing

- Government and Defense

- Others

- Country Insights:

- Saudi Arabia

- UAE

- Qatar

- Bahrain

- Kuwait

- Oman

For an in-depth analysis, you can refer to a sample copy of the report: https://www.imarcgroup.com/gcc-risk-management-market/requestsample

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Key highlights of the report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current, and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Comments