Varicose veins from chronic venous insufficiency can be bothersome and sometimes painful, affecting millions of insurance cover varicose vein treatment their symptoms, a common concern arises “Are varicose vein treatments covered by insurance?”’ In this article, you will explore the factors that determine insurance coverage for varicose vein treatments

What Are Varicose Veins?

Varicose veins are a medical condition wherein the leg veins extend, leading to discoloration or physical abnormality, which includes bulging or twisting. Symptoms include aches, soreness, restless legs, muscle aches, or heaviness. They may also indicate a more severe scientific situation, specifically blog clots or leg ulcers. Varicose veins affect approximately 33 percent of girls and 20 percent of fellows and result from getting older, obesity, leg accidents, menopause, or being pregnant.

Factors considered for scientific necessity standards may include:

1. Symptom severity: Insurance companies frequently require patients to demonstrate substantial symptoms, which include pain, swelling, aching, heaviness, itching of the skin near the ankles, or discomfort that affects their daily sports and excellent of existence.

2. Conservative treatment: Before approving insurance for varicose vein treatment, coverage agencies may also require sufferers to undergo conservative treatment, such as compression socks or lifestyle modifications. These measures are meant to alleviate symptoms and are frequently considered initial steps.

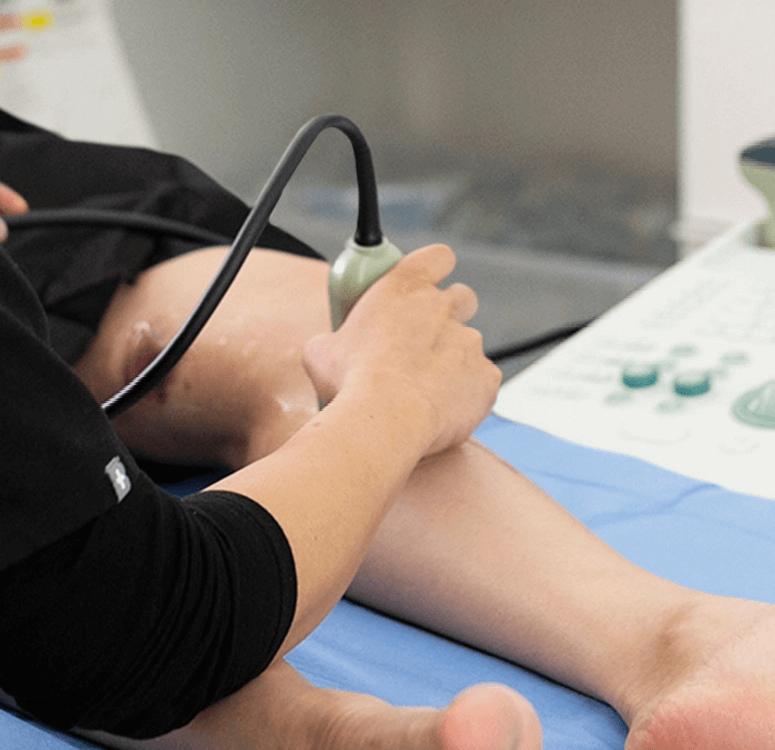

3. Objective checking out: In maximum cases, insurance vendors can also request objective checking out, including ultrasound imaging, to verify the presence of venous insufficiency or determine the severity of the circumstance.

4. Associated complications: Insurance is more likely for folks who enjoy complications due to varicose veins, which include terrible wound healing, bleeding from the veins, or contamination.

How Much Does Varicose Vein Treatment Cost

If you're wondering, “How Much Does Varicose Vein Treatment Cost?” Because many factors impact vein pain, the cost depends on various factors, such as where and what type of pain you feel.

Does Insurance Cover It?

Sometimes, you get confused about “How much does it cost to get your veins stripped?” You can now enjoy the benefits of varicose vein treatment because your insurance will cover it. The succinct answer is correct. Most coverage groups will process a claim for varicose veins if they are considered medically necessary.

Insurance organizations will not cover treatment if the physician considers it a cosmetic technique.

Therefore, claimants must have a medical diagnosis and a doctor’s referral. Doing so often requires the patient to suffer headaches from leg ulcerations, ruptured veins, or blood clots. Get an ultrasound to determine an extreme medical condition when you have already attempted preventative measures, such as exercising, weight reduction, heat-cold packs, or other self-remedies. You may need to offer ultrasound results to your coverage organization so they can process the declaration.

Conclusion

While insurance coverage for varicose veins is adequate for most patients, it depends on meeting medical necessity criteria. However, even those without insurance or limited coverage options can turn to Vein for affordable solutions. Varicose vein treatments are accessible and cost-effective, ensuring patients can relieve their symptoms and improve their quality of life. Contact a vein doctor today to learn more about our discounted patient direct payment options and comprehensive care.

Comments