Lithium Metal Price in USA

- United States: 145625 USD/MT (Lithium Metal 99.9%)

In the United States, in Q4 2023, lithium metal prices saw a significant drop to 145625 USD/MT (Lithium Metal 99.9%). This decrease was influenced by reduced demand and an increase in low-priced imports, mainly from China, Zimbabwe, and Australia.

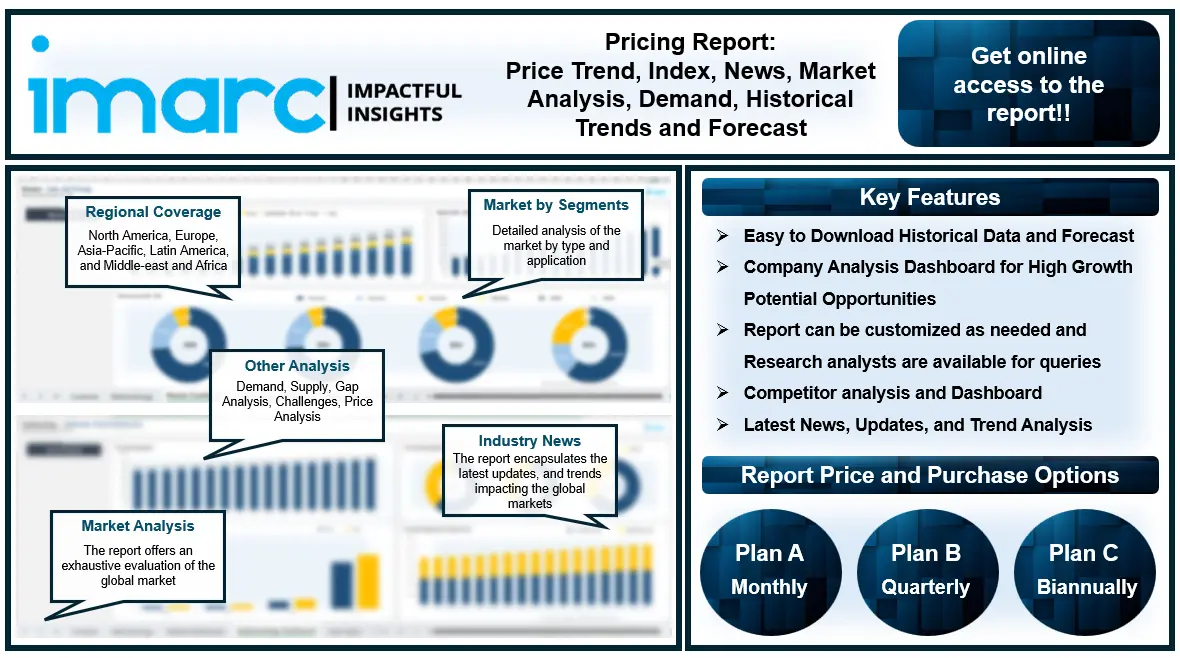

The latest report by IMARC, titled "Lithium Metal Pricing Report 2024: Price Trend, Chart, Market Analysis, News, Demand, Historical and Forecast Data" delivers a comprehensive analysis of lithium metal prices on a global and regional scale, highlighting the pivotal factors contributing to price changes. This detailed examination includes spot price evaluations at key ports and an analysis of pricing structures, such as Ex Works, FOB, and CIF, across North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Lithium Metal Prices December 2023:

- United States: 145625 USD/MT (Lithium Metal 99.9%)

- Germany: 41351 USD/MT (Lithium Metal Granulate)

Report Offering:

- Monthly Updates: Annual Subscription

- Quarterly Updates: Annual Subscription

- Biannually Updates: Annual Subscription

The study delves into the factors affecting lithium metal price variations, including alterations in the cost of raw materials, the balance of supply and demand, geopolitical influences, and sector-specific developments.

The report also incorporates the most recent updates from the market, equipping stakeholders with the latest information on market fluctuations, regulatory modifications, and technological progress. It serves as an exhaustive resource for stakeholders, enhancing strategic planning and forecast capabilities.

Request For a Sample Copy of the Report: https://www.imarcgroup.com/lithium-metal-pricing-report/requestsample

Lithium Metal Price Trend- Q4 2023

The lithium metal market is currently shaped by multiple forces, primarily driven by the expanding electric vehicle (EV) industry and the increasing demand for energy storage solutions. As countries worldwide intensify their efforts towards sustainable energy, the demand for lithium, a crucial component in lithium-ion batteries, has surged. This demand is further bolstered by technological advancements that improve battery efficiency and lifespan, making lithium-ion batteries more attractive for a range of applications from portable electronics to large-scale energy storage systems. Additionally, governmental policies promoting clean energy and providing subsidies for EVs are amplifying this demand.

Lithium Metal Market Analysis

The global lithium metal market size reached US$ 2.5 Billion in 2023. By 2032, IMARC Group expects the market to reach US$ 13.4 Billion, at a projected CAGR of 20.60% during 2023-2032. However, the market is also facing challenges such as fluctuating raw material costs and geopolitical tensions that affect supply chains. Innovations in battery recycling technologies are emerging to address material scarcity, potentially stabilizing supply in the long term. Despite these challenges, the growth trajectory of the lithium metal market remains robust, fueled by the critical role of lithium in the global transition to renewable energy and the ongoing technological advancements in battery technology.

In North America, the lithium metal prices in the first quarter of 2024 were heavily influenced by an oversupply and a decrease in consumer demand. The market saw a significant decline in prices as manufacturers grappled with shrinking profit margins and an influx of low-cost imports, particularly from China, Zimbabwe, and Australia. This influx exacerbated the existing oversupply, putting further downward pressure on prices. Additionally, the subdued demand from the lithium-ion battery sector, due to cautious consumer spending and competitive pressures from Chinese electric vehicle manufacturers, contributed to the bearish market sentiment.

The Asia-Pacific region, particularly China, experienced considerable price volatility in the lithium metal market during the same period. Prices were primarily affected by an oversupply driven by cheaper imports and increased production efficiencies in Chinese manufacturing. The high supply coupled with weak demand from the downstream lithium-ion battery manufacturing industry led to significant price reductions. The regional market dynamics were further compounded by declining raw material costs, enabling Chinese manufacturers to offer more competitive prices, thereby intensifying the price declines across the region.

Europe's lithium metal market faced similar challenges, with significant price decreases driven by weak demand and an influx of low-cost imports. The lithium-ion battery manufacturing sector in Europe, especially in Germany, saw reduced demand which influenced the broader market. Oversupply issues were exacerbated by imports from Zimbabwe and Australia, leading to inventory build-ups and restricted market activity. This oversupply, combined with cautious consumer behavior in response to falling prices, resulted in a bearish sentiment and declining prices across the European market.

Browse Full Report: https://www.imarcgroup.com/lithium-metal-pricing-report

Key Points Covered in the Lithium Metal Pricing Report:

The report delivers the following key findings, alongside a comprehensive breakdown of prices by region:

- Lithium Metal Prices

- Lithium Metal Price Chart

- Lithium Metal Demand & Supply

- Lithium Metal Market Analysis

- Demand Supply Analysis by Type

- Demand Supply Analysis by Application

- Demand Supply Analysis of Raw Materials

- Lithium Metal Price Analysis

- Lithium Metal Industry Drivers, Restraints, and Opportunities

- Lithium Metal News and Recent developments

- Global Event Analysis

- List of Key Players

Regional Price Analysis:

- Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand

- Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece

- North America: United States and Canada

- Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru

- Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco

Browse More Pricing Reports By IMARC Group:

Note: The current country list is selective, detailed insights into additional countries can be obtained for clients upon request.

About Us:

IMARC is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145 | United Kingdom: +44-753-713-2163

Comments