Introduction:

In today's fast-paced world, keeping track of our financial commitments can be a daunting task. However, with the help of technology and a little organization, it's possible to stay on top of your bills and ensure timely payments. One powerful tool that can assist you in this endeavor is a bill calendar spreadsheet. In this article, we will explore the benefits of using a calendar spreadsheet to manage your bills effectively and provide you with a step-by-step guide to creating one. Whether you're a student, a busy professional, or simply looking for a better way to stay organized, this article will help you thrive financially.

Benefits of Using a Bill Calendar Spreadsheet:

1. Enhanced Organization: A bill calendar spreadsheet allows you to have a consolidated view of all your bills in one place. By having a centralized location for tracking due dates, amounts, and payment methods, you can significantly reduce the chances of missing payments and incurring late fees.

2. Timely Payment Reminders: One of the key advantages of a bill calendar spreadsheet is its ability to send reminders. By setting up automated notifications, you'll receive alerts well in advance of your bill due dates, ensuring you never miss a payment. This feature is particularly useful for those with busy schedules or who tend to overlook payment deadlines.

3. Financial Planning: With a bill calendar spreadsheet, you can forecast your upcoming expenses more accurately. By having a clear overview of when bills are due, you can plan your budget accordingly, ensuring that funds are available when needed. This proactive approach empowers you to make smarter financial decisions and avoid unnecessary stress.

Creating a Bill Calendar Spreadsheet:

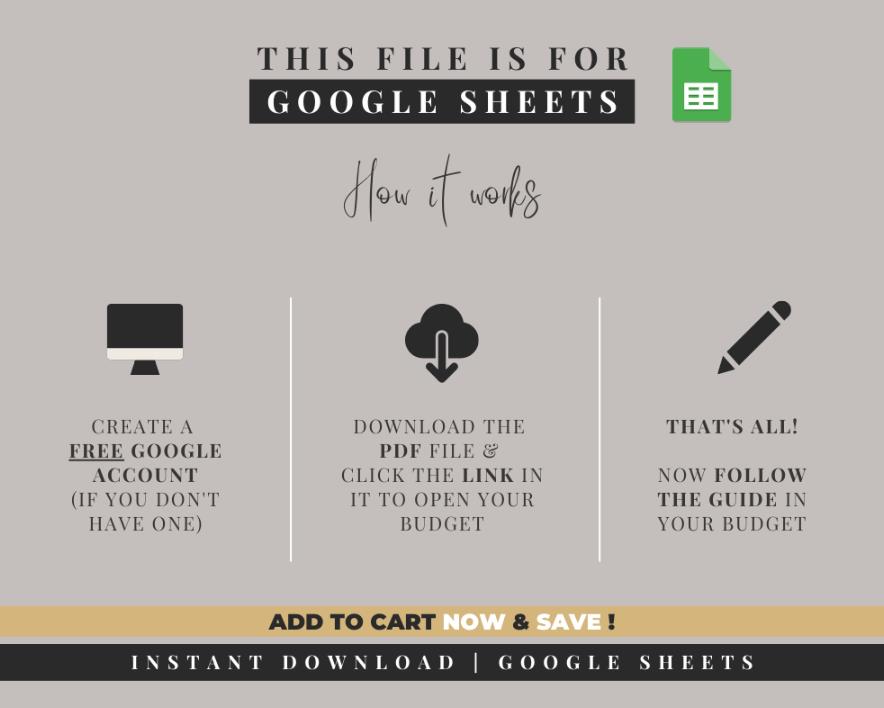

Step 1: Open a Spreadsheet Application: Begin by opening a spreadsheet application such as Microsoft Excel, Google Sheets, or Apple Numbers.

Step 2: Create Column Headers: Label the columns with relevant information, including bill name, due date, the amount due, payment method, and any additional notes you find helpful.

Step 3: Input Your Bill Information: Fill in the rows with the corresponding details of your bills, including the due dates and amounts. Add any optional notes that may assist you in managing your bills more effectively.

Step 4: Set Up Reminders: Utilize the reminder feature within your spreadsheet application to set up notifications for each bill. Choose a notification frequency that suits your needs, such as daily, a few days before, or on the due date.

Step 5: Customize and Personalize: Tailor the spreadsheet to fit your preferences. Add color coding, conditional formatting, or additional tabs to track different types of expenses, such as utilities, subscriptions, or loans.

Conclusion:

Managing your bills doesn't have to be overwhelming or stressful. By leveraging the power of a Bill Planner Spreadsheet, you can bring order to your financial obligations and ensure timely payments. With enhanced organization, timely reminders, and better financial planning, you'll have peace of mind knowing that your bills

For more info:-Weekly Budget Template

Comments