If you are overwhelmed by debt and struggling to keep up with bills, filing Chapter 7 bankruptcy in Virginia may offer a fresh financial start. While the process may seem daunting, Chapter 7 bankruptcy is a legal tool designed to help individuals and businesses eliminate unsecured debt and regain financial stability. Understanding what filing chapter 7 bankruptcy in virginia entails, its eligibility requirements, and the benefits it offers can help you make an informed decision about whether it’s the right choice for your situation.

What is Chapter 7 Bankruptcy?

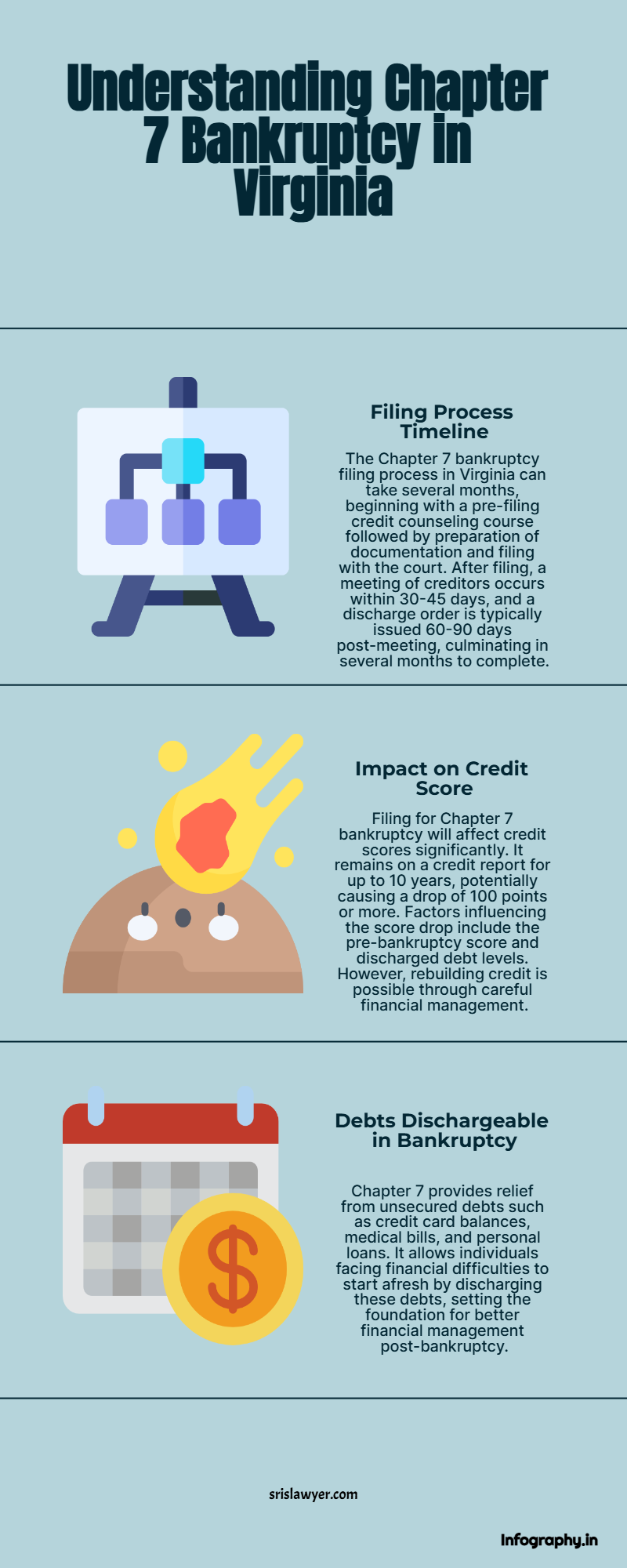

Chapter 7 bankruptcy, also known as "liquidation" bankruptcy, is a legal process that allows individuals to discharge most of their unsecured debts, such as credit card balances, medical bills, and personal loans. The process involves a bankruptcy trustee who will sell non-exempt assets to pay off creditors. However, many people filing for Chapter 7 bankruptcy in Virginia find that they can keep most, if not all, of their property because Virginia has exemptions that protect certain assets.

Unlike Chapter 13 bankruptcy, where you create a repayment plan to pay off debts over time, Chapter 7 bankruptcy typically involves a quicker resolution. Most Chapter 7 cases take about three to six months to complete, and at the end, eligible debts are discharged, meaning you are no longer legally required to pay them.

Eligibility for Chapter 7 Bankruptcy in Virginia

Before filing for Chapter 7 bankruptcy in Virginia, it’s important to determine if you qualify. The primary factor in determining eligibility is the means test. The means test compares your average monthly income to the median income for a household of your size in Virginia. If your income is below the median, you are generally eligible to file for Chapter 7. However, if your income is above the median, you may still qualify, but you will need to go through a more detailed calculation of your expenses to determine if you can afford to repay some of your debt.

Additionally, individuals who have filed for bankruptcy in the past may be subject to time restrictions. For example, you cannot file for Chapter 7 bankruptcy if you have received a discharge in a prior Chapter 7 case within the last eight years, or in a Chapter 13 case within the last six years.

The Process of Filing Chapter 7 Bankruptcy in Virginia

Filing for filing chapter 7 bankruptcy in virginia involves several steps, each of which requires careful attention to detail. Here’s a general overview of the process:

- Credit Counseling: Before you can file for Chapter 7 bankruptcy in Virginia, you must complete a credit counseling course from an approved agency. This course must be completed within 180 days before filing and is designed to help you explore alternatives to bankruptcy.

- Filing the Petition: To begin the bankruptcy process, you must file a petition with the bankruptcy court. This petition includes a detailed list of your assets, liabilities, income, and expenses. You will also need to provide information about your financial history, such as recent property transfers and income tax returns.

- Automatic Stay: Once you file the petition, an automatic stay goes into effect. This means creditors must stop all collection activities, including phone calls, lawsuits, and wage garnishments. The automatic stay provides immediate relief and prevents further financial stress while your case is pending.

- Appointment of a Trustee: After your case is filed, a bankruptcy trustee is appointed to oversee your case. The trustee’s role is to review your assets, determine which ones are non-exempt, and sell them to pay your creditors. However, most people filing for Chapter 7 bankruptcy in Virginia will have few or no non-exempt assets, and their property may be protected by exemptions.

- 341 Meeting of Creditors: About a month after filing, you will attend a meeting called the "341 meeting of creditors." This is a brief meeting where the trustee and creditors can ask you questions about your finances and your bankruptcy petition. In most cases, creditors do not attend this meeting, and it is relatively straightforward.

- Discharge of Debts: If everything goes smoothly, the court will issue a discharge order about three to six months after your filing. This discharge eliminates most unsecured debts, providing you with a clean slate. However, certain debts, such as student loans, child support, alimony, and some tax obligations, cannot be discharged in Chapter 7 bankruptcy.

Benefits of Filing Chapter 7 Bankruptcy

There are several significant advantages to filing Chapter 7 bankruptcy in Virginia, including:

- Debt Discharge: One of the most significant benefits of Chapter 7 is the ability to eliminate most unsecured debts, giving you the opportunity to start fresh without the burden of overwhelming financial obligations.

- Quick Process: Chapter 7 bankruptcy is typically resolved within a few months, unlike Chapter 13 bankruptcy, which can take three to five years to complete. This allows you to regain financial stability faster.

- Protection from Creditors: Once you file for Chapter 7 bankruptcy, the automatic stay immediately halts collection actions, including wage garnishments, lawsuits, and harassing phone calls from creditors. This provides immediate relief from creditor pressure.

- Preserving Exempt Property: Many filers in Virginia can keep their property thanks to Virginia’s generous bankruptcy exemptions. This means you may not have to give up your home, car, or personal belongings.

Considerations and Potential Downsides

While Chapter 7 bankruptcy offers many benefits, it’s important to consider some of the potential downsides. For example, your credit score will likely drop after filing for bankruptcy, and it may take several years to rebuild your credit. Additionally, Chapter 7 may not be an option if you have significant non-exempt assets or if your income is too high to pass the means test.

Furthermore, Chapter 7 bankruptcy does not discharge certain types of debt, such as student loans, child support, alimony, or most tax debts. If you owe these types of debts, you may still be liable for them after the bankruptcy process is complete.

Conclusion

filing chapter 7 bankruptcy in virginia can provide much-needed relief from overwhelming debt, allowing you to start fresh financially. However, it’s important to understand the process, eligibility requirements, and potential consequences before proceeding. Working with an experienced bankruptcy attorney can help you navigate the complexities of the process and ensure that your rights are protected every step of the way. If you’re struggling with debt, a skilled attorney can help you determine if Chapter 7 is the best solution for your situation and guide you toward a brighter financial future.

Comments