Introduction:

Exploring the vast landscape of cryptocurrencies often leads to encountering the foundational concept of “trading pairs,” a crucial element facilitating the exchange of diverse digital assets. This guide aims to elucidate trading pairs, shedding light on their importance and mechanisms, thereby empowering you to navigate the cryptocurrency arena with confidence.

Understanding the Dynamics of Trading Pairs:

At its essence, a trading pair symbolizes the amalgamation of two distinct cryptocurrencies exchanged against each other on platforms facilitating cryptocurrency transactions. These pairs establish a link between disparate assets, determining the comparative value of one asset relative to the other.

For instance, envision the BTC to INR trading pair, emblematic of trading Bitcoin (BTC) to Indian Rupees (INR). This pair can serve as a vital conduit for individuals seeking to understand how to buy Bitcoin in India and monitor the value of Bitcoin in terms of Bitcoin to Indian Rupees.

Navigating the Mechanics of Trading Pairs

Trading pairs function on the fundamental principles of supply and demand dynamics. When a trader seeks to acquire a specific cryptocurrency, they initiate a buy order, specifying the desired quantity and the cryptocurrency they aim to exchange.

Conversely, when a trader intends to sell a cryptocurrency, they execute a sell order, indicating the quantity they wish to sell and the cryptocurrency they expect to receive in return.

The platform facilitates the matching of buy and sell orders from a myriad of traders, leveraging the available trading pairs. The pricing of a cryptocurrency within a trading pair is contingent upon the equilibrium between its supply and demand. As demand surges, prices tend to escalate accordingly, and vice versa.

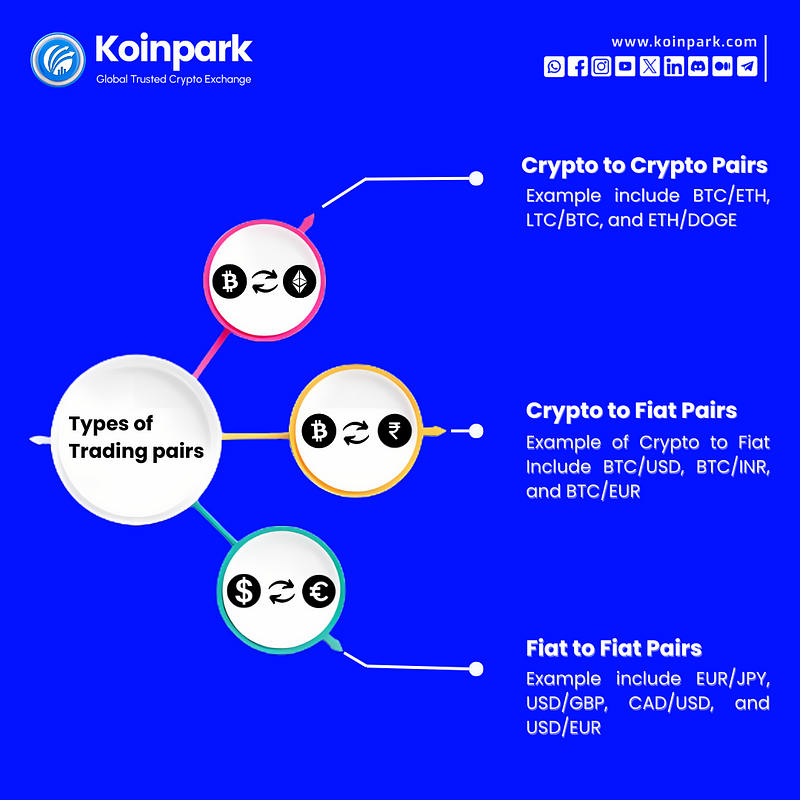

Exploring the Diverse Array of Trading Pairs:

Crypto-to-Crypto Pairs: These pairs encompass the exchange of one cryptocurrency for another. Prominent examples include BTC/ETH (Bitcoin/Ethereum), LTC/BTC (Litecoin/Bitcoin), and ETH/XRP (Ethereum/Ripple).

Crypto-to-Fiat Pairs: This category entails the exchange of a cryptocurrency for a fiat currency such as INR, USD, EUR, or GBP. Examples encompass BTC/INR, BTC/USD (Bitcoin/US Dollar), ETH/EUR (Ethereum/Euro), and XRP/GBP (Ripple/British Pound).

Fiat-to-Fiat Pairs: While less common, certain platforms offer trading pairs involving distinct fiat currencies. Instances include USD/EUR (US Dollar/Euro), USD/GBP (US Dollar/British Pound), and EUR/JPY (Euro/Japanese Yen).

Emphasizing the Significance of Trading Pairs:

Price Discovery: Trading pairs play a pivotal role in facilitating price discovery, providing a benchmark for assessing the value of a cryptocurrency vis-à-vis other assets.

Augmenting Liquidity: By bridging the gap between buyers and sellers, trading pairs bolster liquidity in the market, fostering narrower bid-ask spreads and smoother trading operations.

Unveiling Arbitrage Opportunities: Discrepancies in prices among diverse trading pairs present enticing arbitrage prospects for traders. Capitalizing on these price differentials, arbitrageurs exploit market inefficiencies to garner profits.

Diversification Avenue: Trading pairs offer traders the avenue to diversify their investment portfolios, enabling exposure to various cryptocurrencies and fiat currencies. Diversification acts as a risk-mitigation strategy while maximizing potential returns.

Conclusion:

In essence, trading pairs serve as the bedrock of cryptocurrency trading on a global cryptocurrency exchange. They facilitate seamless asset exchanges, empowering traders to make well-informed decisions and seize lucrative opportunities within the digital currency realm. Whether navigating a website or a cryptocurrency exchange app, these platforms serve as the hub for facilitating cryptocurrency transactions, enabling individuals worldwide to partake in the dynamic realm of digital finance, and selecting the best exchange platform to buy bitcoin.

.png)

Comments