In the ever-evolving finance landscape, a new paradigm is emerging, one that challenges traditional models and democratizes investment strategies. Enter the era of Decentralized Hedge Fund and Investment Management. This groundbreaking approach is transforming how we perceive and engage with investment opportunities. In this article, we explore decentralized investment management's potential and positive impacts, shedding light on a revolutionary platform that embodies this shift.

Decentralization Redefined: Empowering Investors

Decentralized investment management represents a seismic shift in the financial sector, breaking from centralized control and empowering investors like never before. Traditional hedge funds often come with barriers to entry, limiting access to a select few. However, the decentralized model opens the door for a more inclusive approach, allowing a diverse range of investors to participate in hedge fund activities. In this decentralized paradigm, decision-making processes become transparent and community-driven. Smart contracts, powered by blockchain technology, automate and execute investment strategies, reducing the need for intermediaries. This enhances efficiency and minimizes the potential for human error, providing a more secure and reliable investment environment.

Democratizing Finance: Inclusivity at the Core

One of the critical advantages of decentralized investment management is its commitment to inclusivity. By eliminating the need for intermediaries and streamlining processes through blockchain, the barrier to entry is significantly lowered. This fosters an environment where seasoned investors and newcomers can participate on an equal footing, contributing to a more diverse and robust investment community. Decentralized Hedge Funds prioritize community engagement, encouraging active involvement in decision-making processes. This democratization of finance enhances transparency and promotes a sense of ownership among investors.

Smart Contracts: The Backbone of Decentralization

At the heart of Decentralized Hedge Fund and Investment Management lies the innovative use of smart contracts. Using smart contracts ensures efficiency and eliminates the need for intermediaries, reducing costs and increasing trust within the community. Intelligent contracts bring a level of transparency that is unparalleled in traditional finance. Investors can track and verify every transaction in real-time, ensuring the fund's activities align with their expectations. This transparency builds trust and serves as a safeguard against fraudulent activities, promoting a more secure investment environment.

Navigating Risks: Decentralized Risk Management Strategies

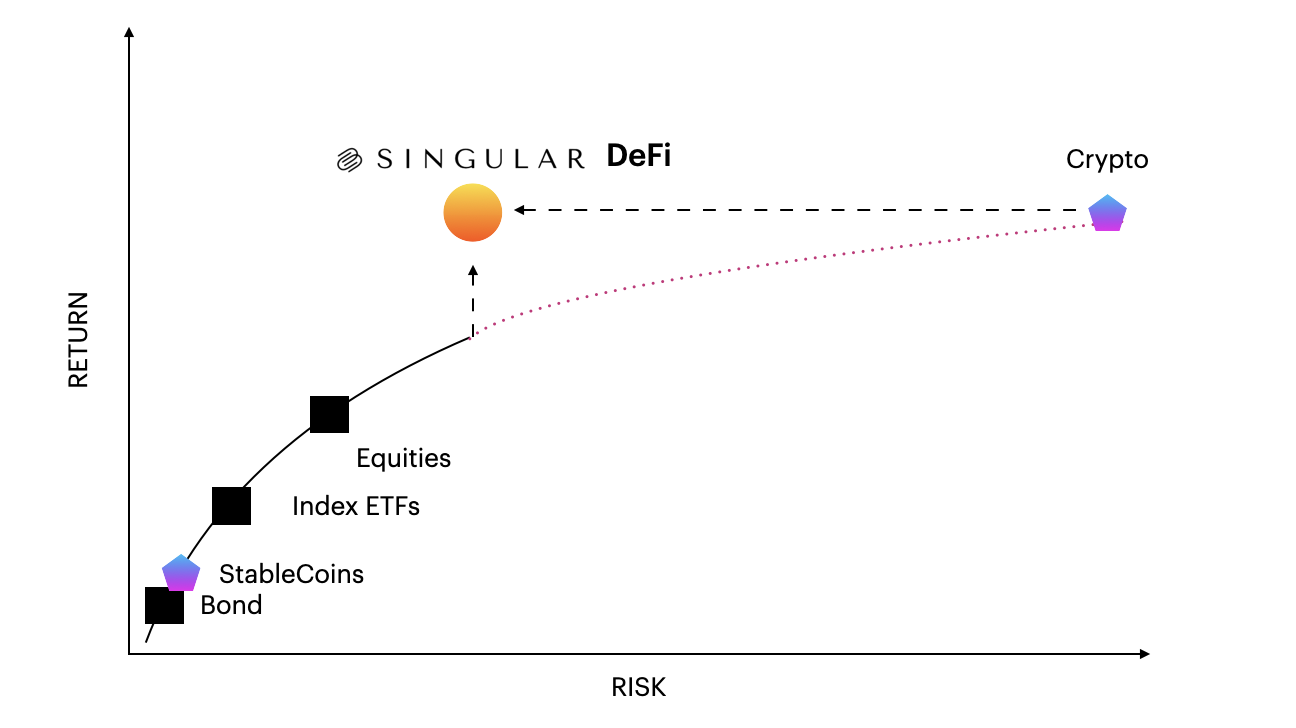

Despite the numerous benefits, decentralized investment management has its challenges. However, the decentralized model itself provides a unique advantage when it comes to risk management. Community-driven decision-making processes allow for diverse perspectives, helping identify and address potential risks more effectively. Additionally, the use of smart contracts enables the implementation of predefined risk management strategies. These automated protocols can respond rapidly to market fluctuations, reducing exposure to unforeseen risks. Decentralized Hedge Funds, equipped with adaptive risk management, are better positioned to navigate the dynamic landscape of the financial markets.

Conclusion:

The Decentralized Hedge Fund and Investment Management era is reshaping the financial landscape, ushering in a new era of inclusivity, transparency, and efficiency. As we navigate this transformative journey, platforms like singularvest.com stand out as pioneers in embracing the potential of decentralized finance. The future of finance is decentralized, and their platform is at the forefront of this revolution.

Blog Source URL:

https://singularvest.blogspot.com/2024/02/revolutionizing-finance-unleashing.html

Comments