Introduction:

In the ever-evolving landscape of personal finance, managing your money efficiently is crucial for achieving financial goals and securing a stable future. One powerful tool that can significantly aid in this endeavor is the Bill Planner Spreadsheet. In this comprehensive guide, we will explore the importance of budgeting, the key features of an effective monthly budget planner, and how to harness its potential to take control of your financial journey.

Why Budgeting Matters:

Budgeting is the cornerstone of financial success. It provides a clear snapshot of your income, expenses, and savings, empowering you to make informed decisions about your money. Whether you're aiming to build an emergency fund, pay off debt, or save for a big purchase, Personal Finance Tracker serves as your roadmap to financial stability.

Key Features of an Effective Monthly Budget Planner:

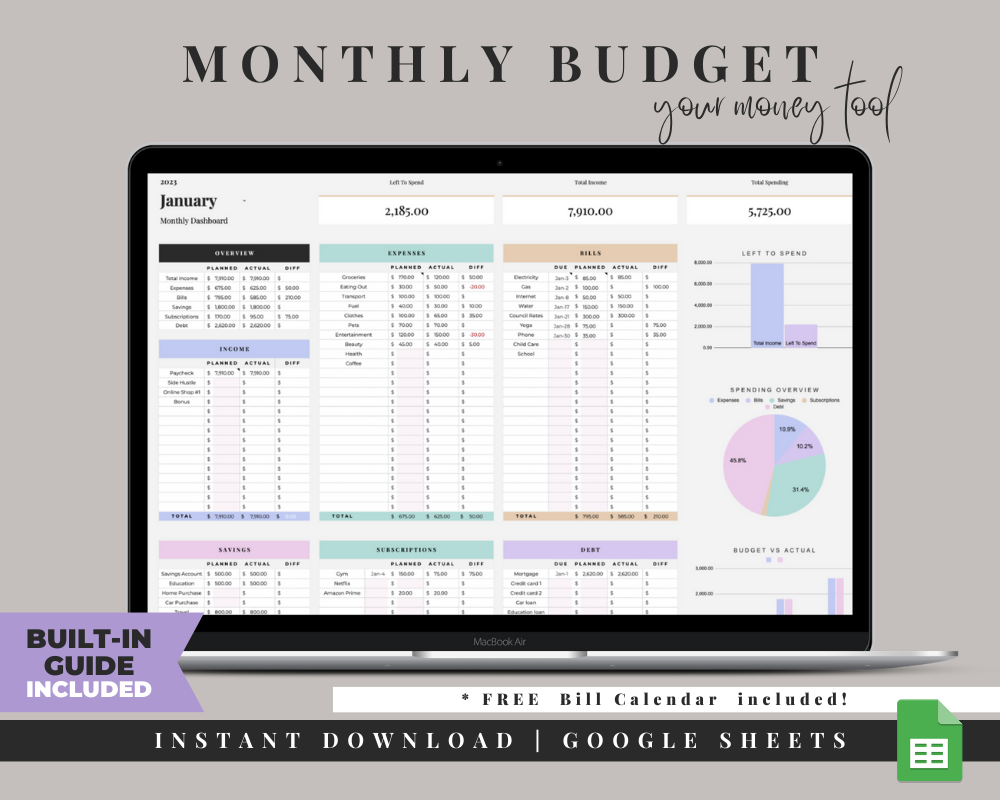

User-Friendly Interface: A good monthly budget planner should be easy to navigate, ensuring that users can input and track their financial information without unnecessary complications. User-friendliness encourages consistent use, making it more likely for individuals to stick to their budgeting goals.

Comprehensive Expense Categories: An effective planner includes a wide range of expense categories, from fixed monthly bills like rent and utilities to variable expenses such as groceries and entertainment. This allows users to account for all their spending and identify areas where they can cut back or reallocate funds.

Goal Setting and Tracking: The ability to set financial goals and track progress is a motivating factor in budgeting. A robust Annual Budget Spreadsheet should provide features for users to establish realistic financial goals and monitor their journey towards achieving them.

Visualizations and Reports: Clear visual representations of financial data, such as graphs and charts, help users understand their spending patterns at a glance. These visualizations make it easier to identify trends, areas for improvement, and celebrate milestones.

How to Effectively Use a Monthly Budget Planner:

Gather Accurate Financial Information: Start by collecting information on your income and all monthly expenses. This includes not only fixed bills but also variable expenses like dining out, shopping, and entertainment.

Categorize and Prioritize: Organize your expenses into categories to gain a better understanding of where your money is going. Prioritize essential expenses and allocate funds to discretionary spending within the limits of your overall budget.

Set Realistic Goals: Establish short-term and long-term financial goals. Whether it's saving for a vacation, building an emergency fund, or paying off debt, setting realistic goals provides direction and motivation.

Regularly Review and Adjust: Your financial situation may change, and unexpected expenses may arise. Regularly review your budget and make adjustments as needed. Flexibility is key to adapting to life's fluctuations.

Conclusion:

A Monthly Budget Planner is a powerful tool that empowers individuals to take control of their finances. By incorporating key features and following effective budgeting practices, anyone can leverage this tool to build a solid financial foundation, achieve their goals, and ultimately secure a brighter financial future. Embrace the discipline of budgeting, and watch as your financial well-being transforms over time.

Source Url :- https://sites.google.com/view/thrivingkoalaxc/home

Comments