MARC Group, a leading market research company, has recently released a report titled "Urea Market Report by Grade (Fertilizers Grade, Feed Grade, Technical Grade), Application (Nitrogenous Fertilizer, Stabilizing Agent, Keratolyte, Resin, and Others), End-Use Industry (Agriculture, Chemical, Automotive, Medical, and Others), and Region 2025-2033". The study provides a detailed analysis of the industry, including the urea market share, growth, size, trends and forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

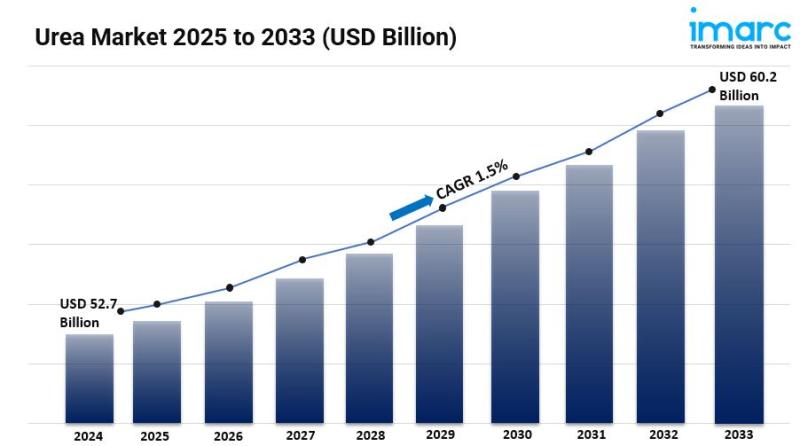

The global urea market size reached USD 52.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 60.2 Billion by 2033, exhibiting a growth rate (CAGR) of 1.5% during 2025-2033.

Request to Get the Sample Report: https://www.imarcgroup.com/urea-market/requestsample

Urea Market Trends in 2025

A notable trend in the urea market is the increasing adoption of digital technologies and data analytics in fertilizer management. As farmers seek more efficient ways to optimize crop yields and resource use, the integration of technology into agriculture is becoming essential. By 2025, it is anticipated that precision farming techniques will gain widespread acceptance, enabling farmers to tailor urea application based on real-time data and soil conditions. This approach minimizes waste and maximizes the effectiveness of fertilizers, leading to better environmental outcomes and cost savings for farmers. Digital platforms and mobile applications that provide insights into nutrient requirements and application timing are becoming more prevalent, facilitating informed decision-making.

Additionally, the use of drones and satellite imagery for monitoring crop health and soil conditions is expected to enhance the precision of urea application. As these technologies continue to evolve, they will not only improve the efficiency of urea usage but also contribute to sustainable agricultural practices, positioning the urea market for growth in an increasingly tech-driven agricultural landscape.

Market Dynamics of the Urea Market

Increasing Agricultural Demand

The urea market is primarily driven by the increasing demand for fertilizers in the agricultural sector. As the global population continues to rise, the need for food production is escalating, leading to a greater reliance on fertilizers to enhance crop yields. By 2025, it is projected that the demand for urea will significantly increase, particularly in developing regions where agricultural practices are evolving. Farmers are increasingly adopting urea as a nitrogen source due to its high nutrient content and cost-effectiveness compared to other fertilizers.

Additionally, advancements in farming techniques, such as precision agriculture, are encouraging the optimized use of urea to improve efficiency and mitigate environmental impacts. This trend is further supported by government initiatives aimed at promoting sustainable agricultural practices, which often include the use of effective fertilizers like urea. As a result, the agricultural sector's growing reliance on urea will continue to shape the market, driving both production and consumption.

Environmental Regulations and Sustainable Practices

Another significant dynamic affecting the urea market is the increasing focus on environmental regulations and sustainable agricultural practices. As concerns about soil health, water quality, and greenhouse gas emissions rise, governments and regulatory bodies are implementing stricter guidelines for fertilizer use. By 2025, the emphasis on sustainability is expected to lead to innovations in urea production and application methods that minimize environmental impact. For instance, the development of coated urea products, which release nutrients gradually, is gaining traction as a means to reduce nitrogen runoff and enhance nutrient use efficiency.

Furthermore, there is a growing trend towards organic farming, which, while traditionally less reliant on synthetic fertilizers, is now exploring the use of organic urea alternatives. This shift is prompting urea manufacturers to invest in research and development to create more sustainable products that meet regulatory requirements while still providing effective solutions for farmers. As sustainability becomes a central theme in agriculture, the urea market will evolve to align with these new standards and consumer expectations.

Fluctuating Raw Material Prices

The urea market is also influenced by the volatility of raw material prices, particularly natural gas, which is a primary feedstock in urea production. The energy market is subject to fluctuations due to geopolitical tensions, changes in supply and demand, and shifts towards renewable energy sources. By 2025, these fluctuations are expected to impact urea production costs and, consequently, market prices. When natural gas prices rise, production costs for urea increase, which can lead to higher prices for consumers and potentially reduce demand in price-sensitive markets. Conversely, if energy prices stabilize or decrease, it may encourage greater production and lower prices, stimulating demand.

Additionally, the trend towards energy efficiency and alternative production methods, such as using biomass or renewable energy sources, is gaining traction in the industry. This shift could mitigate some of the risks associated with raw material price volatility, allowing for more stable pricing in the urea market. Manufacturers that adapt to these changes will be better positioned to navigate the challenges posed by fluctuating raw material costs.

Champagne Market Report Segmentation:

Breakup by Grade:

• Fertilizers Grade

• Feed Grade

• Technical Grade

Technical grade represented the largest segment, accounting for the majority of the market share for fertilizers, feed, and technical grades.

Breakup by Application:

• Nitrogenous Fertilizer

• Stabilizing Agent

• Keratolyte

• Resin

• Others

Nitrogenous fertilizer dominated the market, accounting for the largest share among applications like stabilizing agents, keratolytes, resins, and others.

Breakup by End-Use Industry:

• Agriculture

• Chemical

• Automotive

• Medical

• Others

Agriculture was the dominant end-use industry, accounting for the largest market share among segments like chemicals, automotive, medical, and others.

Breakup by Region:

• North America

• Asia Pacific

• Europe

• Latin America

• Middle East and Africa

Asia Pacific dominated the global urea market, holding the largest market share among regions like North America, Europe, Latin America, and the Middle East & Africa.

Top Companies Operated in Urea Industry:

The competitive landscape of the urea market size has been studied in the report with the detailed profiles of the key players operating in the market.

• Acron Group

• BASF SE

• BIP (Oldbury) Limited

• EuroChem

• Jiangsu Sanmu Group Co. Ltd.

• Koch Fertilizer LLC

• OCI N.V

• Petrobras

• Qatar Fertiliser Company

• SABIC

• Yara International ASA

Key Highlights of the Report:

• Market Performance (2019-2024)

• Market Outlook (2025-2033)

• Market Trends

• Market Drivers and Success Factors

• Impact of COVID-19

• Value Chain Analysis

• Comprehensive mapping of the competitive landscape

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No: (D) +91 120 433 0800

United States: +1-631-791-1145

Comments