Introduction: In today's fast-paced business environment, the need for efficient and accurate financial processes is paramount. An Automated Reconciliation System (ARS) offers organizations a powerful solution to streamline reconciliation tasks, improve accuracy, and enhance productivity. This article explores the benefits, features, and implementation considerations of an Automated Reconciliation System.

Benefits of an Automated Reconciliation System:

Time Savings: An Automated Reconciliation System eliminates the need for manual reconciliation tasks, saving valuable time for finance teams. By automating repetitive tasks, employees can focus on more strategic activities that drive business growth.

Accuracy and Error Reduction: Manual reconciliation processes are prone to human errors, leading to discrepancies in financial records. An Automated Reconciliation System uses advanced algorithms to match transactions accurately, reducing the risk of errors and ensuring data integrity.

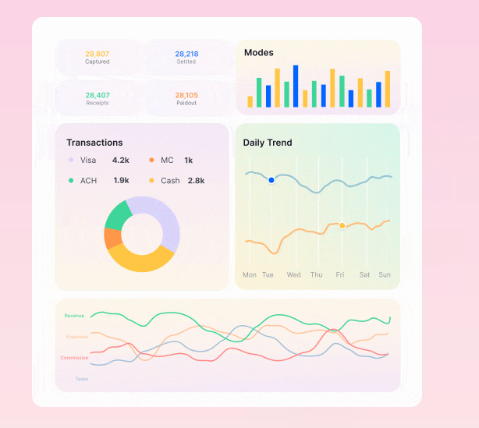

Real-Time Visibility: With an Automated Reconciliation System, organizations gain real-time visibility into their financial transactions and balances. This enables finance teams to make informed decisions and respond quickly to changes in cash flow or account balances.

Improved Compliance: An Automated Reconciliation System helps organizations maintain compliance with regulatory requirements and internal controls. By ensuring accurate and timely reconciliation of financial transactions, businesses can mitigate the risk of non-compliance and potential penalties.

Scalability: As businesses grow and transactions increase, an Automated Reconciliation System can scale to accommodate higher volumes without compromising performance or accuracy. This scalability ensures that organizations can continue to effectively manage their financial processes as they expand.

Key Features of an Automated Reconciliation System:

Data Integration: An Automated Reconciliation System integrates data from multiple sources, such as bank statements, accounting software, and ERP systems, to provide a comprehensive view of financial transactions.

Matching Algorithms: Advanced matching algorithms enable the system to automatically reconcile transactions based on predefined criteria, such as amount, date, and reference number.

Exception Handling: The system identifies and flags exceptions or discrepancies in reconciled transactions, allowing finance teams to investigate and resolve issues promptly.

Reporting and Analytics: An Automated Reconciliation System generates reports and provides analytics dashboards to help finance teams monitor reconciliation status, track trends, and identify areas for improvement.

Audit Trail: A built-in audit trail records all reconciliation activities and changes, providing a transparent and traceable record of financial transactions for audit purposes.

Implementation Considerations:

Assessment of Needs: Conduct a thorough assessment of your organization's reconciliation processes, pain points, and requirements to determine the most suitable Automated Reconciliation System.

Vendor Selection: Choose a reputable vendor with a proven track record of delivering reliable and scalable reconciliation solutions. Consider factors such as industry experience, customer references, and product features.

Customization and Integration: Ensure that the Automated Reconciliation System can be customized to meet your specific business needs and integrated seamlessly with existing systems and workflows.

Training and Support: Provide comprehensive training to finance teams on how to use the Automated Reconciliation System effectively. Additionally, ensure access to timely support and assistance from the vendor.

Continuous Improvement: Regularly evaluate the performance and effectiveness of the Automated Reconciliation System, and implement updates or enhancements as needed to optimize its functionality and efficiency.

Conclusion: An Automated Reconciliation System offers organizations a powerful tool to streamline financial processes, improve accuracy, and enhance productivity. By leveraging advanced technology and features such as data integration, matching algorithms, and exception handling, businesses can effectively manage their reconciliation tasks and gain real-time visibility into their financial transactions. With careful consideration of implementation considerations and best practices, organizations can harness the full potential of an Automated Reconciliation System to drive success and growth.

For more info. visit us:

Integrated Treasury Management System

Tools to Automate Finance Processes

Comments