Embarking on the journey of self-employment brings forth unique financial challenges. In the realm of financial management, self-employed individuals often find themselves navigating uncharted waters. In this article, we explore the art of creating Self Employed Pay Stub—a crucial tool in mastering the intricacies of personal finance.

The Self-Employed Challenge

Being your own boss comes with a myriad of benefits, but it also introduces financial complexities. Unlike traditional employment, where paychecks arrive consistently, self-employed professionals must proactively manage their income and expenses. This is where the art of creating self-employed pay stubs becomes a valuable skill.

Why Self-Employed Pay Stubs Matter

Pay Stubs for Self Employed are not just pieces of paper or digital records. They are powerful financial instruments that serve multiple purposes. From facilitating accurate tax filing to providing a clear snapshot of financial health, pay stubs are the backbone of a self-employed individual's financial identity.

Crafting Your Financial Identity

Your financial identity is a reflection of how you manage your money. Self-employed pay stubs play a pivotal role in shaping this identity by offering a tangible record of your earnings and expenditures. Crafting a solid financial foundation begins with understanding and optimizing these crucial documents.

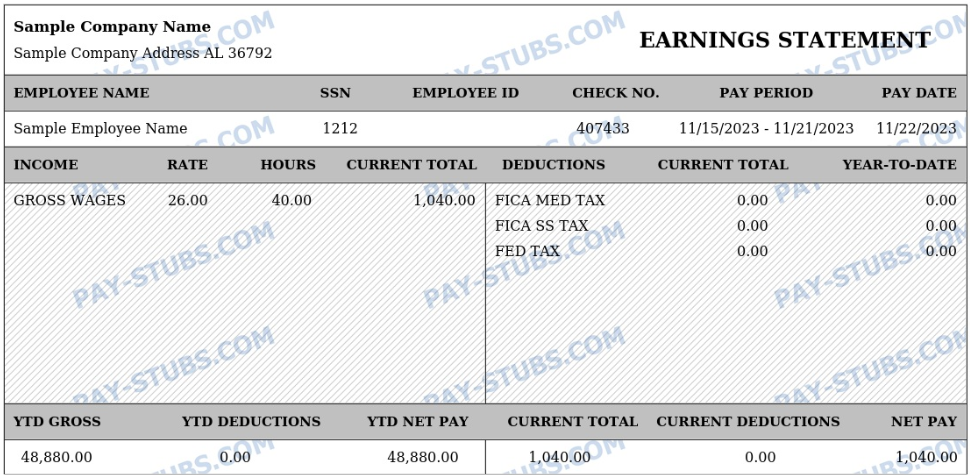

Understanding the Components of a Pay Stub

Before delving into the art of creating pay stubs, it's essential to understand their anatomy. From gross income to deductions and net pay, each component contributes to the overall financial narrative. This understanding empowers individuals to make informed decisions about their money.

DIY vs. Professional Services

The decision to create Paystubs independently or enlist professional services is a crucial one. We weigh the pros and cons of both approaches, providing insights to help individuals choose the method that aligns with their unique needs and preferences.

The Role of Technology

Technology has revolutionized the way we manage finances, and pay stub creation is no exception. In this section, we introduce cutting-edge tools and apps designed to simplify the pay stub creation process for self-employed professionals.

Maximizing Deductions and Benefits

Self-employed individuals have the opportunity to leverage pay stubs for tax deductions and benefits. This section offers practical strategies for maximizing financial outcomes through meticulous documentation and strategic planning.

Conclusion

In conclusion, the art of creating Paystub for Self Employed is a transformative skill for those navigating the self-employment landscape. From understanding the components of a pay stub to embracing technology and maximizing financial benefits, this article serves as a comprehensive guide to mastering the financial intricacies of self-employment.

Comments