Introduction

Managing your finances effectively is a crucial aspect of achieving financial security and achieving your long-term goals. An annual budget planner is a powerful tool that can help you take control of your finances, monitor your spending, and make informed financial decisions. In this article, we will explore the benefits of using an annual budget planner, discuss various tools and resources available, and offer strategies for successful budgeting.

Benefits of Using an Annual Budget Planner

- Financial Clarity: An annual budget planner allows you to see your financial situation clearly. You can track your income, expenses, savings, and investments in one place, giving you a comprehensive overview of your financial health.

- Goal Setting: With a budget planner, you can set specific financial goals, whether it's saving for a vacation, paying off debt, or building an emergency fund. Having clear goals provides motivation and direction for your financial journey.

- Expense Tracking: Tracking your expenses is essential for identifying spending patterns and areas where you can cut back. Many budget planners categorize expenses, making it easy to see where your money is going.

- Debt Management: If you have debts, a budget planner helps you create a plan to pay them off systematically. You can allocate a portion of your income to debt repayment, accelerating your journey to debt freedom.

- Emergency Preparedness: A well-structured budget includes an emergency fund category. This financial cushion can help you weather unexpected expenses or income disruptions without derailing your overall financial stability.

Tools for Annual Budget Planning

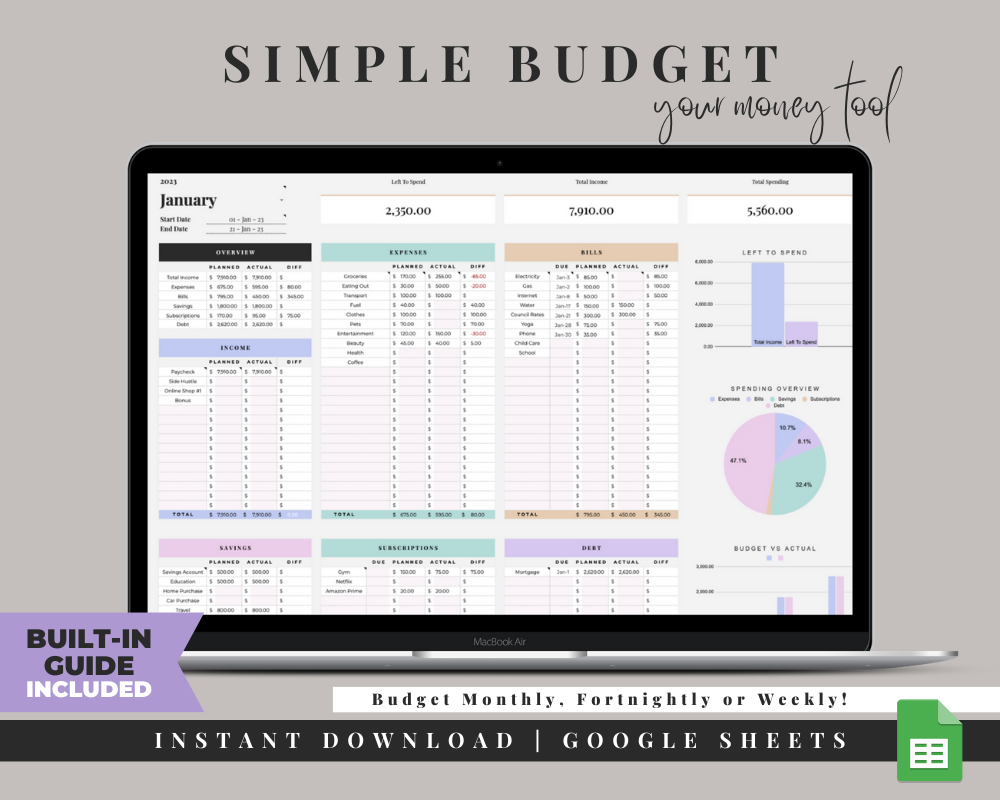

- Budget Google Sheets: Google Sheets offers free, customizable budget templates that you can access from any device with internet access. These templates include pre-made formulas for tracking income and expenses, making budgeting convenient and accessible.

- Bill Planner Spreadsheet: A bill planner spreadsheet helps you keep track of your recurring monthly bills, such as rent or mortgage payments, utilities, insurance premiums, and subscriptions. It ensures you never miss a payment and helps you plan for upcoming expenses.

- Personal Finance Tracker: Personal finance tracker apps and software, like Mint or YNAB (You Need A Budget), offer comprehensive tools for budgeting, expense tracking, and financial goal setting. They sync with your bank accounts and credit cards, automating much of the data entry.

- Weekly Budget Planner: Some individuals prefer to budget on a weekly basis. Weekly budget planners help you break down your monthly income and expenses into manageable weekly segments, allowing for more granular control over your finances.

- Personal Finance Spreadsheet: For those who like to customize their budgeting experience, personal finance spreadsheets offer complete flexibility. You can create your own budget template in software like Microsoft Excel or Google Sheets, tailoring it to your unique financial situation.

Strategies for Successful Budgeting

- Set Clear Goals: Define your financial goals, both short-term and long-term. Whether it's buying a home, retiring comfortably, or simply saving more, having specific goals will give your budgeting efforts purpose.

- Track Every Expense: Record all your expenses, no matter how small. This practice will help you identify areas where you can cut back and ensure you don't overspend.

- Review Regularly: Review your budget regularly to assess your progress and make necessary adjustments. Life circumstances and financial priorities can change, so your budget should be flexible.

- Build an Emergency Fund: Prioritize building an emergency fund to cover unexpected expenses. Aim for at least three to six months' worth of living expenses.

- Seek Professional Help: If your financial situation is complex or you're struggling with debt, consider consulting a financial advisor or counselor. They can provide tailored guidance to help you achieve your financial goals.

Conclusion

An annual budget planner is a powerful tool that empowers you to take control of your finances, set and achieve your financial goals, and make informed decisions about your money. Whether you choose a budgeting app, spreadsheet, or a combination of tools, the key is consistency and discipline in tracking your income and expenses. By following effective budgeting strategies and staying committed to your financial goals, you can achieve greater financial stability and work towards a more secure and prosperous future.

For more info:-

Comments