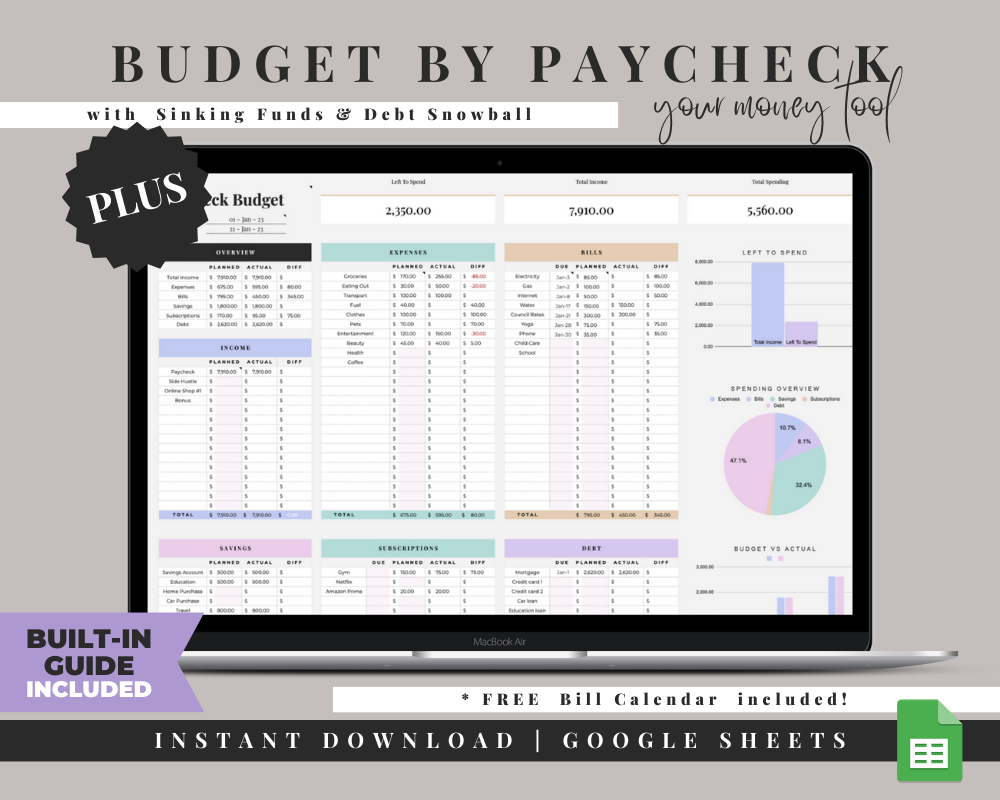

In the modern age of financial complexity, finding balance and control in our personal finances is essential. Enter the personal budget spreadsheet – a digital tool that empowers individuals to manage their money with precision and purpose. From debt payoff trackers to Sinking Funds Tracker, monthly budget spreadsheets, bill planner spreadsheets, monthly budget planners, and savings trackers, these versatile tools have become indispensable in helping people navigate their financial journey.

Debt Payoff Tracker: The Path to Financial Liberation

Debt can often feel like a weight dragging us down, but with a debt payoff tracker, the path to financial liberation becomes clear. A debt payoff tracker allows individuals to list their debts, interest rates, and payment schedules. By entering their monthly payments, users can visualize their progress and witness their debt gradually shrinking. This visual representation becomes a powerful motivator, encouraging responsible financial choices and empowering individuals to regain control of their financial health.

Sinking Funds Tracker: A Lifeline for Future Expenses

Sinking funds trackers are a strategic tool for preparing for anticipated expenses. Rather than being caught off guard by irregular or annual expenses like vacations, car repairs, or holiday gifts, a sinking funds tracker enables individuals to save incrementally over time. By allocating a portion of their income to different sinking funds, users can ensure that they're financially prepared when these expenses inevitably arise.

Monthly Budget Spreadsheet: Taming Financial Chaos

At the heart of effective financial management lies the monthly budget spreadsheet. This comprehensive tool allows individuals to map out their monthly income, fixed expenses, variable expenses, and savings goals. By creating a clear and detailed overview of their financial landscape, individuals can make informed decisions about how to allocate their resources and prioritize their spending.

Bill Planner Spreadsheet: Staying Ahead of Obligations

Staying on top of bills and due dates can be a challenge, especially in our fast-paced world. A bill planner spreadsheet acts as a digital assistant, helping individuals organize their recurring bills, due dates, and payment amounts. This tool ensures that bills are paid on time, avoiding late fees and preserving financial stability.

Monthly Budget Planner: Setting the Stage for Financial Success

A monthly budget planner is the cornerstone of a well-managed financial life. By setting clear goals and breaking down expenses, individuals can align their spending with their values and aspirations. This tool facilitates transparency, accountability, and self-awareness, ultimately leading to improved financial habits and long-term success.

Savings Tracker: Cultivating Financial Growth

Saving money is a pivotal component of financial wellness, and a savings tracker provides a visual record of progress. Whether saving for emergencies, major purchases, or future goals, a savings tracker allows individuals to set milestones and celebrate their achievements. The act of monitoring savings growth also reinforces positive financial behavior, encouraging individuals to consistently contribute to their financial security.

Empowering Financial Independence

The power of personal budget spreadsheets lies in their ability to empower individuals with knowledge, organization, and control. These digital tools transform financial chaos into clarity, anxiety into confidence, and uncertainty into strategy. With debt payoff trackers, sinking funds trackers, monthly budget spreadsheets, bill planner spreadsheets, monthly budget planners, and savings trackers, individuals can confidently navigate their financial journey, making informed decisions that align with their goals and aspirations.

As we embrace the digital age, harnessing the capabilities of personal budget spreadsheets becomes an essential step toward achieving financial independence and embracing a future of financial security and freedom.

For more info:-

Comments